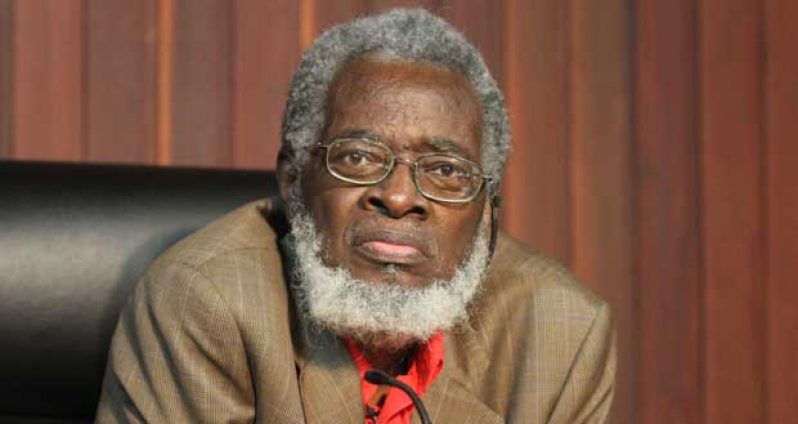

– Dr. Luncheon says Sept 2015 the likely new deadline

GUYANA has been mandated, by the Financial Action Task Force (FATF), to undertake a number of steps to address the shortcomings in the local Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) framework.

Among these which were outlined in a statement by FATF are:

* Adequately criminalising money laundering and terrorist financing;

* Establishing and implementing adequate procedures for the confiscation of assets related to money laundering;

* Establishing and implementing an adequate legal framework for identifying, tracing and freezing terrorist assets;

* Establishing a fully operational and effectively functioning financial intelligence unit;

* Establishing effective measures for customer due diligence and enhancing financial transparency; Strengthening suspicious transaction reporting requirements; and

* Implementing an adequate supervisory framework.

According to the international watchdog, “Guyana made a high-level political commitment to work with the FATF and CFATF to address its strategic AML/CFT deficiencies and Guyana will work on implementing its action plan to address these deficiencies.”

FATF has also stressed that Guyana must act with urgency to address the deficiencies in the local AML/CFT framework.[box type=”shadow” align=”alignright” width=”300px” ]To become FATF compliant, Guyana MUST: * Adequately criminalising money laundering and terrorist financing; * Establishing and implementing adequate procedures for the confiscation of assets related to money laundering; * Establishing and implementing an adequate legal framework for identifying, tracing and freezing terrorist assets; * Establishing a fully operational and effectively functioning financial intelligence unit; * Establishing effective measures for customer due diligence and enhancing financial transparency; Strengthening suspicious transaction reporting requirements; and * Implementing an adequate supervisory framework.[/box]

Additionally, the country will be subject to the body’s ongoing process of improving AML/CFT compliance.

“As part of its on-going review of compliance with the AML/CFT standards, the FATF has to date identified the following jurisdictions (including Guyana) which have strategic AML/CFT deficiencies for which they have developed an action plan with the FATF. While the situations differ among each jurisdiction, each jurisdiction has provided a written high-level political commitment to address the identified deficiencies. The FATF welcomes these commitments,” the international body said.

Both FATF and Caribbean Financial Action Task Force (CFATF), the FATF-style regional body (FSRBs), is expected to continue to work with Guyana and to report on the progress made in addressing the identified deficiencies.

“The FATF will closely monitor the implementation of these action plans…the FATF calls on Guyana to complete the implementation of action plans expeditiously and within the proposed timeframes,” the international watchdog said.

NEW DEADLINE

Relative to the new proposed timeframe, Head of the Presidential Secretariat (HPS), Dr. Roger Luncheon, disclosed that September 2015 is the likely new deadline for Guyana.

“Guyana has staved off blacklisting,” he said, during a news conference held yesterday at the Office of the President.

According to him, Guyana has been fortunate enough to have been given time “to put its house in order” and enact FATF compliant AML/CFT legislation.

Guyana was referred to FATF last November by the CFATF), after missing a compliance deadline, as a result of which the country was blacklisted regionally.

The move was a result of Guyana’s cited failures relative to the passage of the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) (Amendment) Bill, which continues to languish before the Parliamentary Special Select Committee reviewing the Bill.

In June this year, Guyana was reviewed by FATF, which decided that the country will be subjected to a targeted review by the Americas Regional Review Group (ARRG). In a letter dated July 9, 2014, FATF officially confirmed its decision to commence a targeted review of Guyana prior to its October 2014 plenary meeting, which ends yesterday. FATF made it clear that the purpose of that targeted review would be to examine the most significant deficiencies in Guyana’s AML/CFT framework that pose a risk to the international financial system.

In September, a team from Guyana, led by the Attorney-General (AG) and Minister of Legal Affairs, Anil Nandlall, met with the ARRG, to finalise a report on the advances made by the country. Coming out of that meeting, Guyana moved to put in place alternatives to address the technical deficiencies in its existing legal and financial legislative architecture for the assessment of FATF.

ARRG is FATF’s specially appointed body comprising representatives from the Americas to work with Guyana for the purpose of making a presentation of Guyana’s case at FATF’s plenary which ended yesterday.

It is based on this report, that FATF made its pronouncement of Guyana being subjected to an ongoing process of improving AML/CFT compliance, as well as its call for action.

(By Vanessa Narine)

.jpg)