FINANCE Minister Dr. Ashni Singh has dismissed widespread concerns over the use of the new $5,000 note, making clear that feedback has been positive since introduction of the note in December 2013.Dr Singh said: “I did a short walkabout on Christmas Eve, and I met no less than 20 people who highlighted the fact that they were immensely pleased (with) the introduction of the $5,000 bill. I can tell you that there are dozens, probably hundreds, out there who said to me they welcome the introduction of the $5,000(bill).”

Dr Singh explained that many in both the public and private sectors have pointed to the benefits of not having to carry around large sums of cash, particularly relative to the possibility of their falling victim to robbery.

Minister Singh said the concerns are unfortunate, as the matter is a “non-issue” that is being harped on. “You hear of one or two stories of skepticism, but what does not get highlighted is the hundreds of business persons who welcome the new bill,” he stressed.

He opined that it is only a matter of time before the wider Guyanese populace makes use of the new note.

The minister said that, on the competitive front, the few isolated businesses that have said they are not accepting the new bill will discover that customers wishing to make use of the $5,000 note are taking their business elsewhere. “It is an ill-conceived policy,” he said.

Dr Singh maintained that, whatever the outcome, Guyana remains a free country; and if persons do not wish to use the $5,000 bill, they are not obliged to, but can continue using the $1,000 bill as the main currency denomination.

“All the bank notes in current circulation are legal tender,” he said.

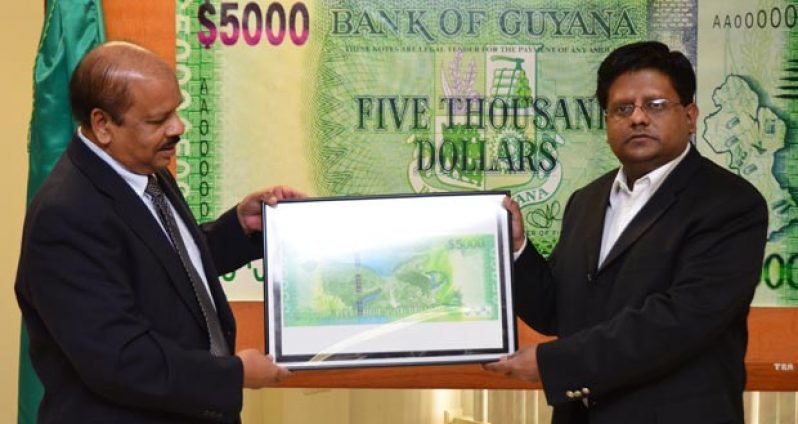

When the new note was introduced, Dr Singh had stressed that the economic growth Guyana has seen since 1996 — the year when the thousand-dollar note was introduced — has warranted the introduction of the new note. The Finance Minister also made it clear that the value of the Guyana dollar remains the same, and is unaffected by introduction of the new note, which is expected to positively impact transactions — from a reduction in the handling costs of particularly large transactions, given that one five-thousand-dollar note will replace five one-thousand-dollar notes; to the increased convenience of consumers handling cash.

The private sector has weighed in on concerns over the new note, calling for an advisory to guide the use of the new $5,000 note, which went into circulation on Monday.

Chairman of the Private Sector Commission (PSC), Mr Ronald Webster, contends that while legal “enforcement” of regulation for the note may not be possible, an advisory can assist in avoiding challenges for the small entrepreneur.

The position of Mr Clinton Urling, President of the Georgetown Chamber of Commerce and Industry (GCCI), is that there should be a minimum limit for which the new bill should be used, in light of the fact that a “change demand” may feed inflation.

“As it stands, business people are at the mercy of consumers who present the $5,000 note for small transactions. What we will end up with will be a change demand, and we may end up printing more $1,000 bills,” he explained.

Both private sector heads stressed their support for the note’s introduction, but maintained their concerns of the “change demand” in relation to its use. However, like the Finance Minister, they agreed that the situation now is a “wait and see” one.

Written By Vanessa Narine

.jpg)