…dubbed newest ‘petrostate’, potentially richest by Bloomberg

GUYANA is on the verge of becoming the world’s newest petrostate and potentially the richest, Bloomberg said in an article on Tuesday.

“In 2015, Exxon Mobil Corp. made what one of its executives described as a ‘fairytale’ discovery in the vast Stabroek exploration block off the Guyanese coast. Since then, it’s found so much oil that by the mid-2020s Guyana, with a population of about 778,000, will probably produce more crude per citizen than any other country,” Kevin Crowley wrote in his article ‘The World’s Newest Petrostate Isn’t Ready for a Tsunami of Cash.’

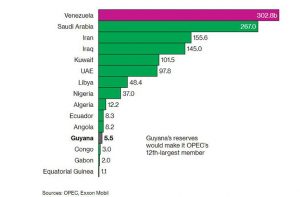

Alluding to the Organisation of the Petroleum Exporting Countries (OPEC), Bloomberg noted that Guyana’s reserves would make it OPEC’s 12th-largest member after Angola. At the time of the compilation of the report, US oil giant ExxonMobil had projected that there were 5.5 billion barrels of oil equivalent resource in the Stabroek Block based on the finds to date. However, that figure has been upgraded to 6 billion barrels. Based on 2018 statistics, Venezuela has the largest barrels of oil reserves with 302.8B followed by Saudi Arabia with 267.0 barrels and Iran with 155.6 barrels.

Bloomberg noted that at Exxon’s Investor Day meeting at the New York Stock Exchange last March, Guyana took center stage. “It’s not hard to see why. Senior Vice President Neil Chapman—the exec who’d once described the Stabroek find as a “fairytale”—pointed to a chart featuring estimates from Wood Mackenzie Ltd., an Edinburgh-based energy consulting firm. It showed that Exxon’s Guyana wells will be the most profitable of all new deep-water projects by major oil companies,” it observed.

In preparation of oil production in 2020, the floating production storage and offloading vessel – FPSO Liza Destiny – is making its way to Guyana. It is due to arrive on September 18. The FPSO will be used by ExxonMobil for the production and processing of hydrocarbons, and the storage of oil.

It is expected that the Oil Company would produce approximate 120,000 barrels of oil per day and gradually increase that amount to 750,000 per day by 2025. The Government anticipates that it would rake in approximately US$300M in 2020 alone and by 2025, a whopping US$5B.

ExxonMobil is gearing up for product at a time when Tullow Guyana B.V – a subsidiary of UK-based oil company Tullow Oil plc, has found oil offshore Guyana at its Jethro-1 well in the Orinduik Block. That find is projected to be more than 100 million barrels of recoverable resources. The company is now preparing to drill its second well – Joe – also in the Orinduik Block while the non-operated Carapa-1 well is also expected to be drilled later this year on the adjacent Kanuku Block test the Cretaceous oil play. With Exxon’s successes, Tullow Guyana remains very optimistic about its prospects.

According to the Director of the Department of Energy Dr. Mark Bynoe, the successful discoveries to date offer significant potential for the diversification of the country’s hydrocarbon production base. He said his department will continue to work assiduously and conscientiously to extract optimum value from these resources for all Guyanese.

Guyana’s economy, with a Gross Domestic Product (GDP) of $3.63 billion, a growth rate of 4.1 per cent in 2018 and 4.6 per cent in 2019, is expected to further grow by 33.5 per cent and 22.9 per cent in 2020 and 2021 respectively. This is according to the NASDAQ Stock Market, which is an American stock exchange. It is the second-largest stock exchange in the world by market capitalisation, behind only the New York Stock Exchange located in the same city.

NASDAQ said, with a per-capita income of $5,194, Guyana is a middle-income country and is covered by dense forest. It is home to fertile agricultural lands and abundant natural resources. Gold, bauxite, sugar, rice, timber and shrimp are among its leading exports.

Back in 2000, the U.S. Geological Survey identified the Guyana-Suriname Basin as the second highest resource potential among unexplored oil basins in the world. ExxonMobil (U.S.), Esso (U.S.), Hess, Repsol (Spain), Anadarko (U.S.), Total (France), Tullow Oil (UK), and CGX Energy (Canada) have been a part of exploration and drilling activities over the years.

ExxonMobil Guyana has made 13 discoveries since 2015 and plans to begin producing up to 120,000 barrels of oil per day from the Liza Phase One development in early 2020. Guyana is projected to be among the world’s largest per-capita oil producers by 2025.

Early this year, the Economic Commission for Latin America and the Caribbean (ECLAC) projected a 4.6 per cent growth rate for Guyana this year even as it updated its growth projections on economic activity for this year for the Region’s countries. In the updated projections, ECLAC slightly lowers its estimate for the regional average to 1.3 per cent compared with the 1.7 per cent foreseen in December 2018, when the institution released its annual report ‘Preliminary Overview of the Economies of Latin America and the Caribbean 2018’.

Recently, in an interview with this newspaper, Finance Minister, Winston Jordan, said that, despite the political fallout following the no-confidence motion, there has been no disruption to the economy which grew by 4.1 per cent last year.

Describing the nation’s economic performance as “solid”, Minister Jordan said the sectors responsible for the “better than expected performance” were sugar, livestock, forestry, gold, diamonds and the wholesale and retail trades. The private sector has been saying that due to “uncertainties” economic activities have slowed. It (the private sector) however, has not produced actual data and method used to arrive at the claims.

Last year’s growth came on the heels of a less than three per cent GDP growth rate in 2017 and bettered the 3.4 per cent growth which was initially projected in November of 2018. The latter was based on figures at hand and projections, explained the minister.

.jpg)