GEORGETOWN, Guyana – (December 16, 2016) THE allocations in Guyana’s 2017 Budget formulate a fiscal programme of action aimed at stimulating economic growth, ensuring progress in infrastructural development, advancing the push toward development of a ‘green’ state, and providing robust educational social programmes that benefit all Guyanese.During his last address to the National Assembly — in October 2016 — President David Granger had laid out the current economic environment, which foretold the need for increased Government revenue to ensure that the balance of payments is met.

“The absence of a policy to provide employment opportunities for you and to reduce extreme poverty, and the failure to energise the manufacturing sector, weakened our economy,” the President said. He said that when the Government took office, the economy was characterised by a lack of strategic planning and by whimsical decision-making, while economic mismanagement was accompanied by huge debts for unpaid international obligations and court judgements.

“The (gravest) financial problem was the bankruptcy of the Guyana Sugar Corporation, which owed 89 billion in debt…. Your government was forced to divert money from economic development and social programmes to rescue the ailing corporation with an immediate injection of $12 billion. An additional $11 billion had to be provided the next year, 2016, making a total of $23 billion bailout in 18 months,” he said.

In spite of these adversities, the Government was able to institute wage increases, raise the income tax threshold, and increase pension and public assistance over the past 18 months. However, mindful of the state of the economy, the Government had to ensure that macro-economic stability is maintained.

On November 28, as the 250-billion-dollar-budget was presented in the National Assembly — under the theme “Building a Diversified Green Economy; Delivering the Good life to all Guyanese” — by Minister of Finance, Mr. Winston Jordan, Budget 2017 was the third budget to be presented by the Coalition Administration during its 18 months in office, and the first in four decades to be presented before the start of the fiscal year.

During the budget presentation, Minister Jordan outlined several transformative measures aimed at improving economic performance and defining a sustainable pathway to a more prosperous state. Some of those measures are: stabilising macroeconomic and public finances; preparing for oil-and-gas production; encouraging and supporting entrepreneurship, in particular those that involve new green technologies and processes; creating more job opportunities; increasing the focus on innovation, to increase domestic production and boost exports; moving towards a Smart Guyana that bridges the digital divide; reforming business facilitation, and expanding economic horizons; building climate-resilient infrastructure for economic expansion, and linking the coastland and hinterland; lifting the quality of life; addressing poverty; and reforming the public and financial sectors.

The minister declared that Government aims to deliver these ambitious goals to the people in spite of troubling economic and social indicators. Though Guyana will see only a 2.6 per cent growth in Gross Domestic Product by the end of 2016, which is less than the expected four per cent, the Government has introduced measures that will bring economic relief to many Guyanese.

Some key measures are: The reduction of Value Added Tax (VAT) from 16 per cent to 14 per cent. The reduction in VAT was a campaign promise, and one the Government is introducing in a phased approach, which allows the Government to still maintain tax revenues to finance the country’s development programmes.

Increase in the tax threshold from $55,000 per month to $60,000 per month. This is the second increase in the threshold under this Government. This measure means that Public Servants working for less than $60,000 per month will not pay income tax, while those with salaries above the threshold will enjoy a lower tax burden on their overall incomes.

Reduction of the personal income tax rate from 30 per cent to 28 per cent for individuals earning less than $180,000 per month. There has also been the introduction of a progressive income tax regime which sees a 40 per cent tax being applied to income above the $180,000 threshold. These persons with higher incomes will benefit from one-third of their incomes being tax free, thereby allowing for a higher “take home” pay.

Increase in Old Age Pension from $18,200 to $19,000. Old Age Pension has seen significant increase since this Administration took office, moving from $13,125 to $17,000 in 2015; to $18,200 last year, and now to $19,000 in the 2017 Budget.

Even as Government has granted these tax breaks, taxation and other revenue-enhancing measures must be put in place for the country to continue along the course of development, particularly infrastructural development. The budget therefore includes several measures in taxation and other areas that seek to achieve this goal.

But the measures of taxation and other aspects of the budget were met with criticism from stakeholders, who raised issues with some matters including the announcement that VAT would be charged on electricity consumption in excess of $10,000 per month, and on water consumption in excess of $1,500 per month. Government has, however, held fast that these and other measures have been put in place to bolster the economy and set a paradigm shift from the economic woes that were inherited.

Minister of Business, Mr. Dominic Gaskin, in an interview on the Budget in Focus, stated that while members of the Private Sector Commission have the right to raise their concerns, the Budget must be assessed holistically in order for the gains to be measured.

With $163 billion in tax revenue to be collected, the minister said, stakeholders should not focus only on the individual impacts for businesses.

“These are all the possibilities for us to collect this money… Any responsible government has to collect taxes in order to fund its programmes,” Minister Gaskin said.

Speaking on the concerns about taxation expressed by stakeholders, Minister of Public Security, Mr. Khemraj Ramjattan, said income tax is a fundamental part of any growing society that seeks to secure a country’s sustainable development.

Government has maintained that the measures in Budget 2017 seek to fix the decline of the economy, and that the provisions and decisions will boost economic growth for all Guyanese.

Minister Jordan, in his closing remarks at the debate, on December 9, responded to several criticisms levied by the Opposition and other stakeholders. The minister said the presentation of the Budget at the beginning of the fiscal year is a practice that is not new, as the earliest budgets from 1968-1977 had taken the same course. He said that a budget that comes out after the fiscal year has begun in a truncated budget, and members of the PSC especially should understand that an early budget would also benefit them significantly.

The administration has also been accused by the Opposition of not conducting relevant consultations in the composition of the budget; an assertion which Minister Jordan rebutted by explaining that while some groups responded to invitations to meet his team of budget planners, several, such as the political Opposition, declined. Consultations for the National Budget were conducted over a period of five months, he explained.

In the area of tax reform, Minister Jordan explained that many of the tax measures implemented were informed by the recommendations of the Tax Reform Committee (TRC) which was established by this Government to review the tax system. Among the recommendations that the TRC made were for VAT to be implemented on electricity and water over specified amounts.

Minister of Social Protection, Ms. Volda Lawrence, also responded to criticisms that the old age pension increase is insufficient. She reminded the House that the old age pension has been increased by this Administration by 45 per cent in the last 18 months.

She also explained to the House that the former Government’s light and water subsidy arrangement was flawed and did not meet the needs of Guyana’s senior citizens.

“I wish to state that the incentives that the Opposition implemented for the elderly — to be exempt from the payment of electricity and water — lacked transparency and did not benefit all the elderly consumers in several areas [around the country]; and hence the records will show that, in 2014, only 10,000 benefited from that electricity programme,” she said.

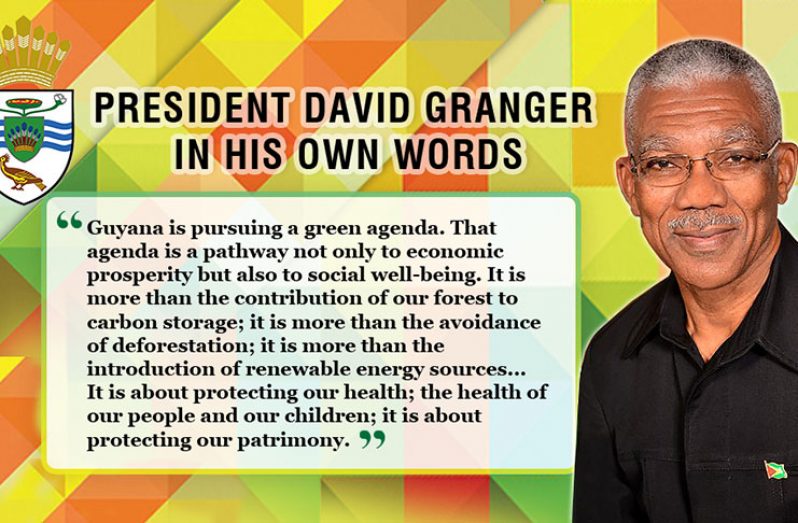

President Granger, on the Public Interest, has said that, overall, the budget introduced a number of measures that are aimed at stimulating the economy and creating employment. Referring to it as a “rounded budget”, the President said the budget covers all the needs of the citizens.

“It caters for economic change, it caters for social protection, and it caters for greater security in terms of the ability of citizens to live in peace and safety from criminal attack. So, taken as a whole, I think the budget provides for all of the needs of citizens during the financial year 2017… Everything has been covered…so my overview is that it is a budget that is easy for citizens to follow and come to conclusions themselves,” he said.

In Part Two of this feature, which will be published next week, a detailed analysis of Budget 2017 will be provided. It will delve into the transformative measures that will place Guyana on a pathway of rapid development over time.

.png)