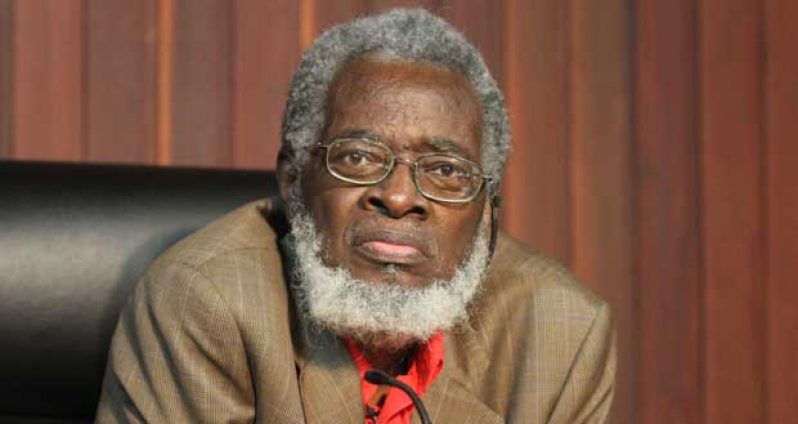

…says damning NIS audit findings must be answered

FORMER Chairman of the National Insurance Scheme (NIS), Dr Roger Luncheon, has sought to defend the administration of the scheme under his watch against the damning findings of a forensic audit which implicated him and the PPP government for playing a heavy hand in its operations.Dr Luncheon also flayed Government for reportedly ignoring him and the previous board during the conduct of the audit, but assured that the report should and must be answered. In a letter to the editor of this newspaper, Dr Luncheon said Guyanese must have noticed the recent publication in the press of the findings of the audit.

He noted that as the chairman of the Board of NIS for the period 2011-2015, within which the audit was done, neither the auditor nor the Government had afforded the board the professional convention of first responding to the audit findings.

Former Head of the Presidential Secretariat, Luncheon said his board was “unceremoniously relieved of its appointment and responsibilities in May 2015, and (was) eventually replaced en bloc, with the exception of an APNU-nominated member.”

Noting that the General Manager of the NIS is by law a member and deputy chairman of the board, Dr Luncheon said the forensic auditor failed to address the issue of whether evidence was unveiled that established that the board had conducted its affairs and obtained financial benefits from irregular actions.

“The findings of the forensic audit that have been displayed in the press should and must be answered. Were the financial auditor or the Granger Government so inclined to solicit such an intervention, it should have been directed to the competent authority,” Dr Luncheon said.

The audit report, done by Ramesh Seebaran and released by the Ministry of Finance, highlighted that NIS office at Corriverton, built in 2011 for $69.9M, was later valued at $37.9M. The report said the Lot 8 Springlands, Corriverton, Berbice building was reconstructed in 2010/2011 and commissioned in 2011 at cost of $69,923,940.

Focusing on the scheme’s investment in the Berbice Bridge Company Incorporated (BBCI), the auditor said the company has several investments in the BBCI; namely corporate bonds — $1,060,000,000; subordinated loan $500,000,000 (which is a debt that ranks after other debts if a company falls into liquidation or bankruptcy); preference shares – $950,000,000; and common shares – $80,000,000.

The ability of BBCI to pay interest, dividends and capital repayment will depend on its ability to generate profits. To date, it has made accumulated losses of $1,507,062,759 based on its 2014 audited financial statements.

“As a result, the investment in BBCI’s common shares may now be impaired, as the current net worth of an ordinary share is $2.77 based on its 2014 audited financial statements.”

Further, it was noted that the 2014 audited financial statements showed that the company signed a concession agreement with the Government of Guyana for the design, construction, development, operations and maintenance of the Berbice Bridge, pursuant to the terms and conditions established within this agreement.

The agreement is for a period of 21 years, unless terminated or extended by mutual agreement or in accordance with any other provisions within the agreement.

When the 2012 audit was finalised in May 2015, it became known to management that the company does not own a bridge, but instead a licence to operate a bridge, even though the scheme had two of its directors on the company’s board.

“This resulted in the auditors reclassifying the cost of the bridge and a building from Fixed Assets to ‘Concession Assets’ and restated the 2010 and 2011 audited financial statements. The effect of the reclassification resulted in those years which had declared taxable profits now showing significant losses.” These losses arose because the Concession Agreement is for a period of 21 years, therefore the bridge is now amortised over that period, whereas it was previously depreciated over a 70-year period.

A copy of the Concession Agreement was not available for review by the auditor. Based on the information available to the auditor, it was discovered that there is a “material uncertainty that cast significant doubt about the entity’s ability to continue as a going concern.”

“It means therefore, that the Scheme’s investment in the BBCI is almost certain to be negatively affected. Already, the ordinary shares have been impaired to a negative value, the subordinate loans preference shares may also have been impaired. The company’s CEO has already written the Scheme, indicating its inability to pay the dividend on preference shares,” the audit report disclosed.

Should BBCI become insolvent because of its current loss-making position, considering its issues with the Government regarding the lowering of the bridge toll, its inability to generate adequate money to meet its obligations, and the fact that the company does not own a bridge, the investors’ investments will be at severe risk of not being recovered.

.png)