MINISTER of Finance Winston Jordan recently affixed his signature to the amended Value Added Tax (VAT) Order, paving the way for additional food supplies and essential commodities to be included in the list of zero-rated items.Among them, multi-function printers not for commercial use, a supply of biscuits, a supply of cereals, fresh carrots, milo and ovaltine, nestum, mustard and mayonnaise, uncooked chowmein, vinegar, uncooked pasta, ketchup, chicken sausages, Chinese sauce, baking powder, liquid detergent, household cleaning agents, paper towels (rolls) and yogurt.

Additionally, the words “but not including other flour such as” was deleted and a comma inserted thereafter in sub-paragraph (i) of Schedule I paragraph 2A(s) of the Principal Act. It now reads: “a supply of (i) plain white wheaten or whole wheat flour, including roti-mix and self-rising flour, high fibre flour, flour made from durum wheat and other exotic flour.”

In light of the amendments, directives have been given for the approved list of items with specific Tariff Headings to be installed in the Guyana Revenue Authority’s, Total Revenue Integrated Processing System (TRIPS) and properly administered by staff within the respective departments, such as the Entry Processing Unit (EPU) of the Customs Excise and Trade Operations and the various ports of entry. Important to note is the fact that tax exemption letter from the Commissioner General (CG) will not be required.

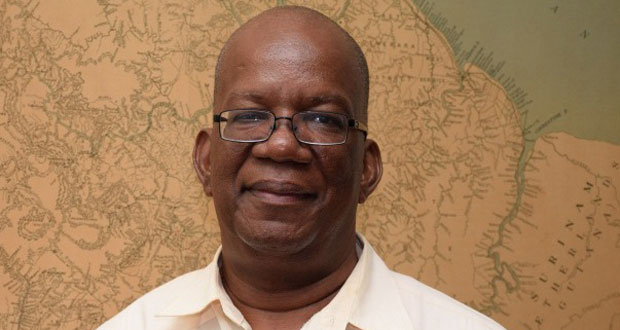

The GRA is appealing for the public to heighten its awareness on zero rated items especially when making purchases from VAT registered businesses. Recently Commissioner-General of the GRA Mr. Khurshid Sattaur reiterated the importance of citizens being vigilant and avoid being duped to pay VAT when they are not required. “You have to educate yourself. Having a quick nimble mind about what attracts VAT and what does not, is important in helping you and the GRA.”

There have been numerous reports of businesses failing to adhere to the policy regarding how they should advertise VAT inclusive products and also failing to provide tax invoices/receipts to consumers.

With reference to Section 90 (2) and (3) of the VAT Act, where a registered person advertises or quotes a price for a good or service that is subject to 16 % VAT, the price is required to include the tax and the advertisement or quotation must state that VAT is included. The customer or consumer then makes a single payment.

.png)