Guyana’s blacklisting will put a spoke in Private Sector’s wheel

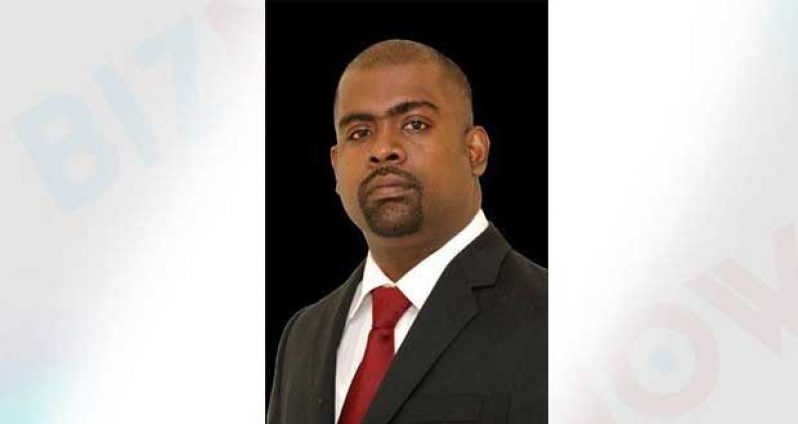

CHAIRMAN of the Private Sector Commission (PSC), Mr. Ramesh Persaud minced no words yesterday when commenting on Guyana being blacklisted internationally as a result of its referral to the Financial Action Task Force (FATF) by the regionally-based Caribbean Financial Action Task Force (CFATF).

And he made it clear that the progress made in the last 10 years by the local private sector, the engine of Guyana’s phenomenal economic growth, will see a significant reverse.

“The counter-measures called for by CFATF as a result of the non-compliance to international AML/CFT standards will reverse the progress made by the Private Sector over the last 10 years,” Persaud told the Guyana Chronicle in an interview.

‘It must be clearly understood that the classification of Guyana by CFATF and the referral of Guyana to FATF lumps both legitimate and illegitimate businesses of Guyana into the same high risk category’ – PSC Chairman, Ramesh Persaud

CFATF, in its public statement to members on Thursday, detailed the counter-measures that can be taken by its members to protect their financial systems from the ongoing money laundering and terrorist financing risks emanating from Guyana. These include:

* The requirement of enhanced due diligence measures;

* Introducing enhanced reporting mechanisms or systematic reporting of financial transactions;

* Refusing the establishment of subsidiaries or branches or representative offices in Guyana; and

* Taking into account the fact that financial institutions from Guyana that do not have adequate AML/CFT systems and limit the business relationships or financial transactions with the country.

Persaud said the counter-measures called for by CFATF, once fully implemented by countries that are trading partners with Guyana, can significantly weaken our economy and reverse the gains made in poverty reduction.

‘The counter-measures called for by CFATF as a result of the non-compliance to international AML/CFT standards will reverse the progress made by the Private Sector over the last 10 years’ – PSC Chairman, Ramesh Persaud

DECLINING INVESTMENT

Guyana was already blacklisted regionally in November 2013, and according to Persaud, there is already evidence of a decline in investments in the private sector.

“Loans and advances to the private sector by the commercial banks,” he said, “is one of the reliable indicators of private sector growth and investments. This was $40.8B in 2004, and rose to $128.2B at the end of December, 2013.

“At the end of the first quarter of 2014, the balance dropped to $127.5B, and has been stagnant for the last three months. This is a sign that there has been a decline in the investments made by the private sector.

“This is linked to a lack of confidence and a high level of skepticism by private enterprises in the economy due to the uncertainties brought about by the possibility of sanctions.”

Noting that the classification of Guyana by CFATF, and the referral of Guyana to FATF lumps both legitimate and illegitimate businesses of Guyana into the same high-risk category, Persaud said: “Legitimate, law-abiding businesses are going to feel the consequences even more, as money launderers and financiers of terrorism will continue to find sophisticated methods of by-passing the system, as they are good at scheming and plotting; and they would not mind the extra cost associated with doing so.

“However, legitimate businesses have no alternative but to comply with the onerous systems, and bear the extra cost. For this, the consumer will eventually suffer, as business models are built to pass on and recover costs fully.”

This is “very disheartening” news for the many members of Guyana’s Private Sector Commission, he said.

‘Legitimate, law-abiding businesses are going to feel the consequences even more, as money launderers and financiers of terrorism will continue to find sophisticated methods of by-passing the system…’

COULD HAVE BEEN AVOIDED

Noting that the situation could have been avoided, had the country’s elected officials, as represented in the National Assembly, acted in the interest of the country rather than in their own self-serving political agendas, Persaud said: “Guyana is already ranked poorly in many international indices, such as the World Bank Doing Business Report and the World Economic Forum Global Competitiveness Report, and the referral to FATF only worsens this situation.”

Just last November, prior to the November 2013 CFATF blacklisting debacle, the PSC sent a petition to the National Assembly, which was voted down by the combined Opposition (AFC and APNU) and not read to the House.

The petition at reference highlighted the serious economic implications if the AML/CFT Bill was not passed before the November 18, 2013 deadline, and had urged the Opposition to support the Bill in the interest of the nation.

In a statement released after the petition’s rejection, the Commission registered its “deep disappointment” in the actions of Opposition MPs, and stressed that the Tenth Parliament will be accountable for any damage that may “accrue to the Guyana economy” going forward.

The PSC maintained that the Opposition has effectively ignored the importance of the private sector as a stakeholder in Guyana’s development, by denying the body a voice in the National Assembly.

The PSC said, “This action reveals an inexplicable contempt for the stakeholders of this country and/or a lack of understanding of how the economy functions.

“In a civilised world, on critical matters of economic and national importance, it is mandatory for leaders to rise above this petty and often retrogressive tit-for-tat disposition.

“We expect nothing less from our elected representatives, who must understand that merit is the most important factor for the people of this country.”

The Commission underscored the role of the private sector as a driver of the local economy, particularly given that it represents the entire economic spectrum of Guyana and provides majority of the employment opportunities – a fact noted in the petition to Parliament.

Referencing this, Persaud issued an appeal for efforts to be made in the National Assembly to ensure that Guyana meets the legislative requirements of an effective AML/CFT regime before the June 2014 Plenary Meeting of FATF in Paris, France.

(By Vanessa Narine)

.png)